We’ve all heard the latest recruiting slogan – “Interview today. Start tomorrow. Get paid the next day.” It sounds too good to be true, right? This slogan refers to one of the latest recruiting tools that employers are adopting in this post-pandemic economy: early wage access.

Early wage access (EWA) goes by many names — earned wage access, wages on-demand, daily pay — but essentially, they all refer to an employee’s ability to access the money they’ve earned before their scheduled payday.

The EWA industry is relatively new. It wasn’t until the last few years that employers have even heard about it. As this new industry gains momentum, an employer could be less desirable to an applicant if this benefit isn’t offered compared to a company that does. It isn’t a matter of whether a company will offer an early wage access benefit, but when.

How does Early Wage Access Impact Employers?

Employers today face an ongoing challenge of attracting and retaining top talent. These vital recruiting techniques rely primarily on compensation and core benefits. However, the company’s culture and the overall employee experience are just as important.

EWA can be a win-win experience for an employee and the employer. An employee can access the money they have already earned from the previous day’s work, and the employer may boost employee morale, ultimately leading to greater productivity.

With every reward comes risk, though. EWA providers that utilize a SaaS (software as a service, i.e., a payroll processing system) may set up employee repayments as a separate direct deposit record or as an employee loan. Suppose the EWA provider doesn’t have the proper protocols for their integration with the SaaS to ensure that both systems reflect the same data. In that case, an employee could go in and remove the new direct deposit line and never have the repayment deducted from their paycheck. Correct integration protocols ensure that an employee would not be able to change any loan deduction or direct deposit entry setup by the EWA provider.

Before moving forward with an EWA provider, the employer must determine the cost associated with offering the service, if any. Some EWA providers require a separate bank account seeded with funds from the employer. Other EWA providers rely on the time and attendance integration or their own algorithms to determine the maximum an employee can draw. If an employee cannot repay a draw and the EWA provider doesn’t require seeded funds from the employer, the EWA provider will assume the exposure.

Implementing an EWA provider can be accomplished with little to no interruption to your current payroll process if the provider is fully integrated with your payroll system. Either EWA providers will integrate with your time and attendance program or apply an algorithm based on the employee’s payroll history to determine the maximum that an employee can draw per day or per pay period. Most EWA providers also include online classes and educational tools to help employees learn about financial wellness.

What is Employee Financial Wellness?

Financial Wellness is a measure of how a person can meet their current and future financial obligations without the insecurity of their financial future and is a factor in their overall wellbeing.

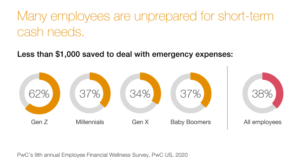

Offering EWA, or wages on demand, as a benefit allows employees to breathe a little easier when assessing their own financial needs. According to a 2020 PwC study, less than 40% of employees have $1,000 or more saved to deal with unexpected expenses.

DailyPay, a current provider in the Early Wage Access industry, reported some of the benefits employers have experienced as a result of offering a wages on demand benefit:

- 1.9x increase in applicants to a job that offers an on-demand pay benefit

- 50%, on average, reduction in turnover

- 49% average increase in employee productivity

- Ability to fill open positions in less than half the time (52% faster)

- 26% reduction in absenteeism

- Applicants are 13% more likely to apply for a lower-paying job with on-demand pay

How does Early Wage Access Impact Employees?

Many workers are currently living paycheck to paycheck and having the freedom to access earned wages before payday can be a lifeline. Access to early wages can mean that an employee could have other options besides taking on overdraft bank fees, late fees, or high-interest payday loans. EWA can also give employees flexibility in meeting urgent care medical costs, car repairs, or paying a bill before it becomes late.

For example, if an employee discovers that they have a flat tire on their way to work, they have the breathing room to instantly access wages and repair or replace the tire without adding to their financial stress.

If an employee can retain more of their money by avoiding late fees and high-interest loan sharks, they can budget better for their monthly expenses. It’s also possible that employees can begin saving money as they learn about their financial wellness and tools that can help their financial wellness improve.

Accessing early wages can cost an employee, though. Where most EWA providers will not have any per-employee-per-month fees for the employer, the EWA provider will charge the employee per EWA transaction if specific deposit methods are requested. It is not uncommon for an EWA provider to offer a pre-paid debit card. If an employee chooses a pre-paid debit card, funds could be made available instantly and at no transaction fee. If an employee makes a draw and requests the funds to send to a separate bank account, a per-transaction fee could cost between $1.50 and $10.00.

Another give and take to consider when drawing earned wages early is what that could mean for the employee when the regular payday comes out. EWA is not an employer loan, so if an employee usually nets $500 on their weekly payroll but draws $250 during the pay period, they will net $250 when the payroll processes for payday. Each employee’s household and circumstances are different, but it is important to realize what EWA is, and each person’s cause and effect.

Ultimately, the decision to offer EWA as a benefit is up to each employer. Like any other benefit offered to employees, simply offering the benefit doesn’t guarantee that every employee within the company will utilize the benefit. However, it could be a benefit worth researching if it makes the difference between winning the recruiting battle and adding more positive items to the company culture.

CHECK OUT NEW EWA BENEFIT OFFERED BY MY HR PROS HERE!

Written By: Lauren Jones, Director of Operations

For questions or additional information contact us! | (800) 940- 8706 | learnmore@myHRpros.com |