My HR Pros keeps our clients up-to-date with all things concerning year-end regulations and documents. We will continue to maintain up-to-date information on this page.

Updated: November 19, 2024

Countdown to

Year-End

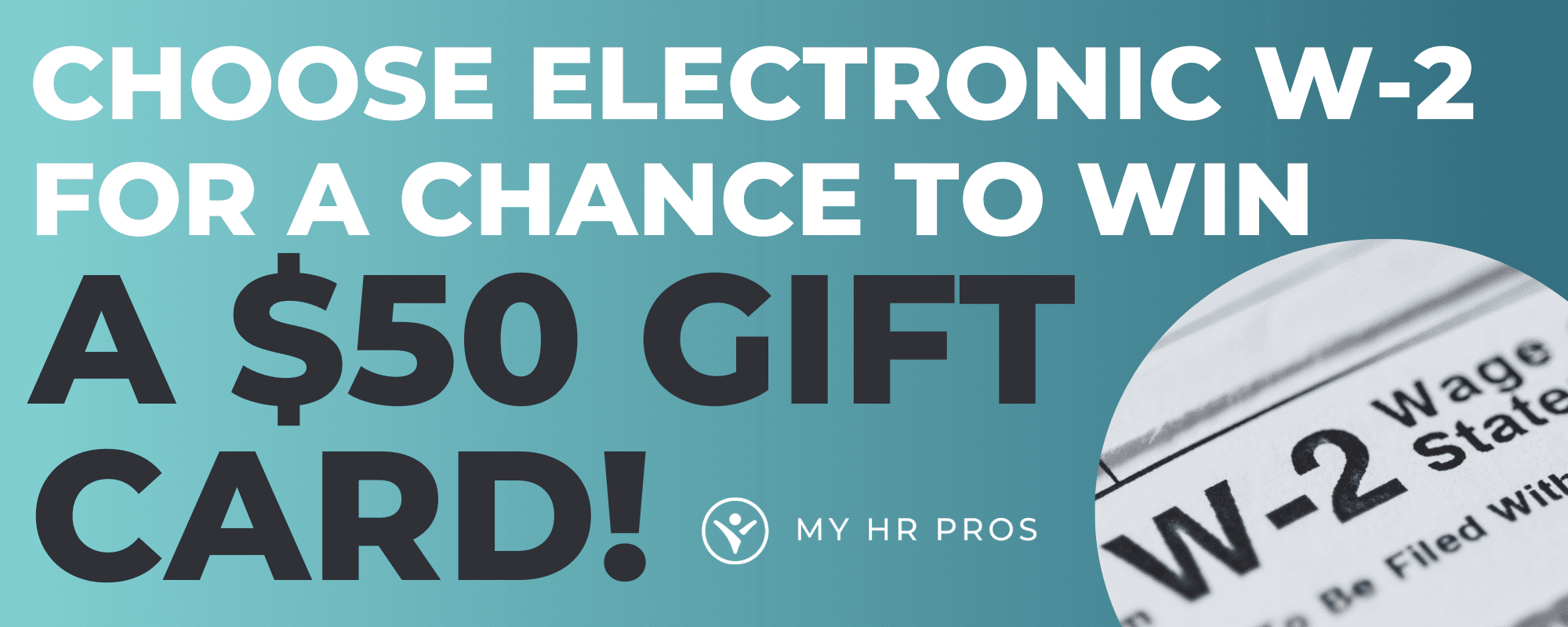

All active employees of My HR Pros clients who opt to receive their W-2s via the My HR Pros Employee Portal by Thursday, December 19, 2024 will be entered for a chance to win one of three $50 Amazon eGift Cards!

Visit the Electronic Employee Portal to enroll in electronic W-2 delivery today!

Department of Labor Salary Threshold:

Regarding the Department of Labor's Salary Threshold: Recent developments have affected the mandatory salary increases under the Fair Labor Standards Act (FLSA) for both 2024 and 2025. This change has broad implications for businesses. We want to ensure you are well-informed and supported during this period of uncertainty. Please see SHRM article, 'How Should Employers Respond Now that Overtime Rule Is Blocked?'.

Here’s what to consider based on your current circumstances:

- If you implemented changes effective July 1, 2024: Please note that many families have already adapted to these adjustments over the past few months. Reversing these changes could potentially impact employee morale and stability significantly. Before making any decisions, we strongly advise consulting with your team, My HR Pros, or with legal counsel.

- If you were planning changes closer to January 1, 2025: Good news—no immediate adjustments are required at this time.

- If you are considering a hybrid approach: You may proceed, but ensure that any modifications to work units or job types are well-documented with clear, objective reasons. This proactive step can help mitigate potential discrimination claims.

Additionally, it remains crucial to review job classifications for compliance. Misclassifications can lead to substantial legal challenges. For guidance on navigating these complexities, please don't hesitate to contact My HR Pros.

Address Updates: For a new or updated address to reflect on your W2, changes must be completed no later than 12/31.

Year End Adjustments: All employer-paid insurance adjustments for specific individuals within your organization will need to be finalized for W-2's files to be processed no later than December 28th. Changes received after December 28th will be charged a $50 fee due to additional work required to amend W-2.