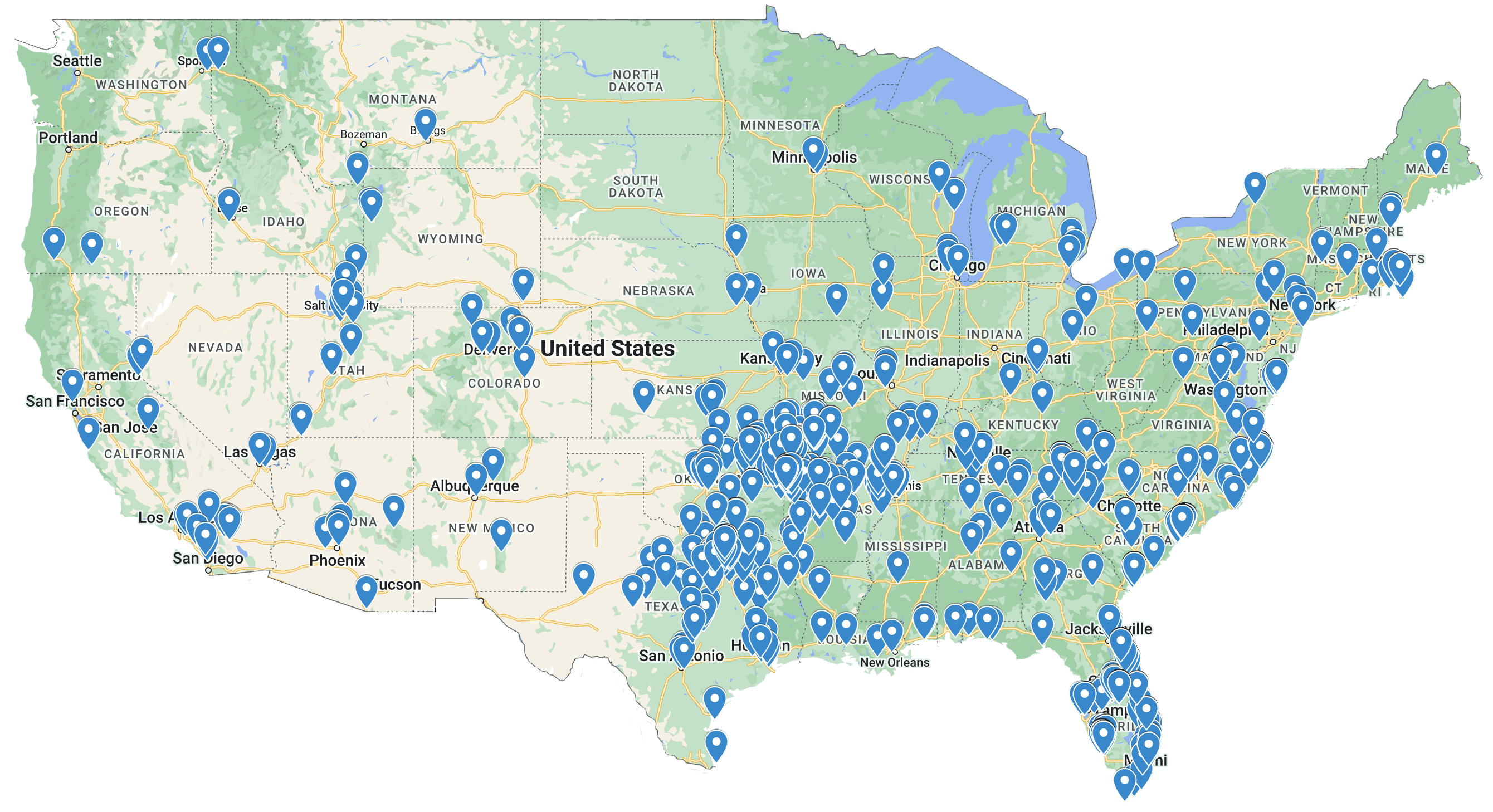

Trusted Human Resources Company in Arkansas & Serving the Nation

Pictured: Staci McElyea, Data Receptionist

Delivering Exceptional Service to Every Corner of the Country!

Our goal at My HR Pros is to remove the administrative and regulatory burdens and empower you to focus on your core business opportunities. With over 25 years of experience, we're the trusted professionals for Arkansas as well as all throughout the Nation.

HR Peace of Mind for You and Your Business

My HR Pros is committed seeing each and every partner succeed. We offer over a dozen services, which means we have the resources to help small businesses with any issues, big or small. How can we help you? Click the link below to schedule a free demo so that you can see what works best for your business! You won't regret it.

My HR Pros' Client Testimonials

Starting a new business? Let us help!

Starting a new business can seem daunting if you don't have all the tools to help you reach success. That's where we come in! My HR Pros has all of the services and software that you need to build your business. Some of our most popular services offered are software solutions, payroll services, bookkeeping, employee benefits admin, and more. Let us be your one-stop shop!

Contact My HR Pros

We work for you and your business to provide professional HR solutions and services. With over 28 years of experience, you can have confidence in our services and team to do the best job possible for your business. Contact us today for any questions or to request a free demo!